child tax credit 2022 extension

How much of the Child Tax Credit can I claim on my 2021 tax return. An increase in the maximum credit that households can claim up to 3600 per child age five or younger and 3000 per child ages six to 17.

/cdn.vox-cdn.com/uploads/chorus_asset/file/23392681/1235261204.jpg)

Why Did Congress Let The Expanded Child Tax Credit Expire Vox

Taxpayers who owe and missed the April 18 filing deadline should file now to limit penalties and interest.

. Democrats in Congress last March approved an expansion of the Child Tax Credit that ran from July through the end of 2021. Not too late to claim the Child Tax Credit for 2021 IR-2022-91 April 19 2022 WASHINGTON The Internal Revenue Service encourages taxpayers who missed Mondays April 18 tax-filing deadline to file as soon as possible. For children under 6 the amount jumped to 3600.

Child Tax Credit extension The enhanced Child Tax Credit payments where distributed last year from July through December. The child tax credit was temporarily expanded for 2021 under the American Rescue Plan Act passed by Congress in March 2021. However despite calls for the expanded Child Tax Credit payments to be continued into 2022 progression has not gone as many in the Democrat party would have hoped.

This means that next year in 2022 the child tax credit amount will return to pre-2021 levels that is up to 1800 per child for children under six years of age and up to 1500 per qualifying child for children aged six to 17. Added January 31 2022 Q A2. What is the amount of the Child Tax Credit for 2021.

US president Joe Biden. You may be eligible for a child tax rebate of up to a maximum of 750 250 per child up to three children. Budget restraints only allowed the credit revamp to be temporary.

2022 Child Tax Credit Extension2022 Child Tax Credit Extension. Payment 1 is due on. Democrats beefed up the child tax credit to a maximum of 3600 for each child up to age 6 and 3000 for each one ages 6 through 17 as part of the American.

Bigger child tax credit for 2021. ANY hope of receiving a child tax credit payment in January 2022 is slowly slipping away as Congress holds the key to more money for Americans. The program extended payments of 250-per-month for children ages 6.

President Biden then settled on a one-year extension for 2022 and wrote that language into his. Making the credit fully refundable. These FAQs were released to the public in Fact Sheet 2022-28 PDF April 27 2022.

The bill signed into law by President Joe Biden increased the Child Tax Credit from 2000 to up to 3600 and allowed families the option to receive 50 of their 2021 child tax credit in the form. In 2021 and 2022 the average family will receive. 2022 Child Tax Rebate The child tax rebate which was recently authorized by the Connecticut General Assembly and signed into law by Governor Ned Lamont is intended to help Connecticut families with children.

In 2021 the CTC increased from 2000 per child under the age of 18 to 3000. This money was authorized by the american rescue plan act which. Added January 31 2022 Q A4.

IRSnews IRSnews May 7 2022 Additional tax credits for children and dependents For each dependent that doesnt qualify for the Child Tax Credit taxpayers may qualify for a 500 Credit for. T he expanded Child Tax Credit came to the aid of many households in the United States during the COVID-19 pandemic but the boosted payments had to come to an end at the start of 2022 after it. However many want it to be made permanent eventually.

Added January 31 2022 Q A3. The Build Back Better Act stalled in the Senate and now Congress is on holiday. Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

However that only applies to the monthly payout of the expanded. The JCT has made estimates that the TCJA changes. Increasing the maximum credit that households can claim to 3600 per child age 5 or younger and 3000 per child ages 6 to 17.

Complete IRS Tax Forms Online or Print Government Tax Documents. A one-year extension was included in the Build Back Better bill. This also means that families will once again have to wait for their tax refund to see the money.

The boosted Child Tax Credit did so much good that lawmakers initially sought to make it permanent. The legislation made the existing 2000 credit per child more generous. You can also use this free online tool to help you calculate your estimated tax payment.

The number of children living in poverty decreased by 40. The quarterly payment schedule for the estimated tax payments in 2022 is as follows. The newly passed New Jersey Child Tax Credit Program gives families with an income of 30000 or less a refundable 500 tax credit for each child under 6 years old.

Last December the CBO estimated that making the 2021 credit under ARPA and the TCJA permanent would cost 1597 trillion between 2022 and 2031. Analysis from Columbia University suggests that 34 million more children lived in poverty in February 2022 compared with December 2021. Not only that it would have modified it to include the following.

What is the 2021 Child Tax Credit. The credit is designed to reduce taxpayers tax liability. President Bidens 2 trillion Build Back Better social spending bill would have continued the the Child Tax Credit through 2022.

The maximum child tax credit amount will decrease in 2022 In 2021 the enhanced child tax credit meant that taxpayers with children ages 6 to 17 could get a credit of up to 3000. For 2022 that amount reverted to 2000 per child dependent 16 and younger.

Benefits Of Expanding Child Tax Credit Outweigh Small Employment Effects Center On Budget And Policy Priorities

Child Tax Credit 2022 How To Claim A Missed Payment Before Tax Deadline Marca

Child Tax Credit 2022 Could You Get 450 Per Child From Your State Cnet

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

Child Tax Credit 2022 Are Ctc Payments Really Over Marca

Child Tax Credit 2022 How Next Year S Credit Could Be Different Kiplinger

Child Tax Credit 2022 Are Ctc Payments Really Over Marca

Is The Enhanced Child Tax Credit Getting Extended This Year Here S The Latest Cnet

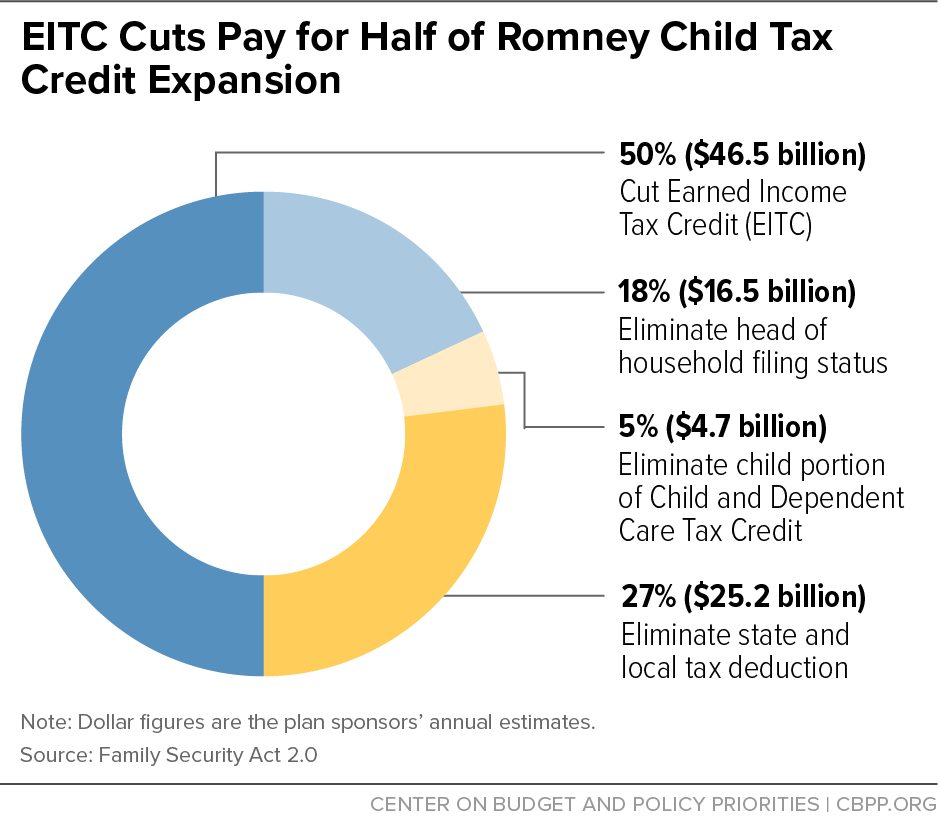

Romney Child Tax Credit Proposal Is Step Forward But Falls Short Targets Low Income Families To Pay For It Center On Budget And Policy Priorities

Child Tax Credit 2022 Could You Receive A Double Monthly Payment In February Marca

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/23423480/GettyImages_1358862098.jpg)

Will There Be An Expanded Child Tax Credit In 2022 Vox

Romney Child Tax Credit Proposal Is Step Forward But Falls Short Targets Low Income Families To Pay For It Center On Budget And Policy Priorities

Parents Guide To The Child Tax Credit Nextadvisor With Time

Child Tax Credit 2022 How Next Year S Credit Could Be Different Kiplinger

Child Tax Credit 2022 How Next Year S Credit Could Be Different Kiplinger

Rising Food And Energy Prices Underscore The Urgency Of Acting On The Child Tax Credit Center On Budget And Policy Priorities

The Advance Child Tax Credit 2022 And Beyond

The Expanded Child Tax Credit Briefly Slashed Child Poverty Npr

Monthly Child Tax Credit Expires Friday After Congress Failed To Renew It Npr